TLDR: Yes (*but better!)

Right this second, you think I’m an idiot. That’s cool. Any bitcoiner that’s been around the block a few times is used to that response, but let’s dig into the numbers and see if you still think I’m an idiot by the end.

Let’s go back in time

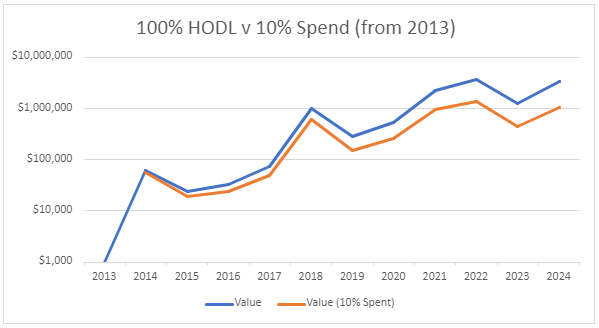

It’s the 1st of January 2013. You’re setting some New Year’s Resolutions and you’ve decided you’re going to take $1000 (all data in USD) and invest in Bitcoin; this crazy internet money you’ve been hearing about.

1 Bitcoin costs $13.30 and you’ve just bought 75.19 of them. Go you!

Back in the present day

You hodled on like a true Bitcoin OG, through all the volatility and self-doubt, and you made it to the 1st of January 2024. 1 Bitcoin is now worth $44.183.40 and your 75.19 are now worth a cool $3,322,060. Your friends call you lucky, but you know the truth, and your pretty happy with your x3322 bagger.

But what if you’d sold 10% every year

If you’d spent 10% every year, by the 1st of January 2023, your 75.19 Bitcoin is now only 23.59 Bitcoin, but it’s still worth $1,042,498.

That’s right. You’d still have a x1042 bagger even though you’d spent 10% every year. Not bad, right?

Hang on. You’re just cherry-picking the data

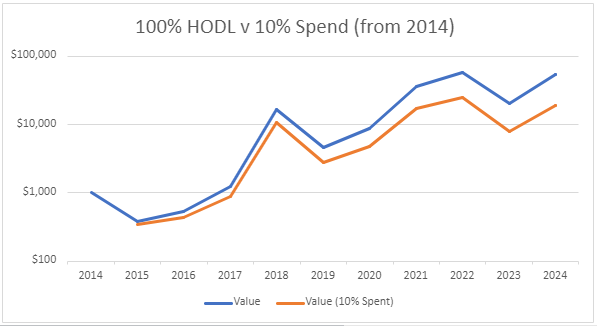

You got me. I did. I picked the 1st of January 2013 because it was an excellent time to buy Bitcoin. But you know when wasn’t? The 1st of January 2014, because for the next 2 years Bitcoin went down. So let’s try that.

So, another year has passed and you didn’t stick to that New Year’s Resolution. Surprise surprise!

But in 2014 you’ve turned over a new leaf and this time your sticking to it. You take the same $1000 and buy Bitcoin. It now buys you only 1.23 Bitcoin (#facepalm).

Back to the time machine

It’s 2024 again and your 1.23 Bitcoin is now worth $54,153. Not the x3322 bagger (not even the x1042 bagger) but x54 is better than a kick in the teeth.

I know what your thinking. This is where the theory all falls apart. If I’d spent 10% every year, I’d now be down, and be feeling pretty sorry for myself.

Fear not, your 1.23 Bitcoin is now “only” 0.43 Bitcoin, but it’s worth $18,882.

So, you’re telling me…

…that even if I first started buying Bitcoin in a “bad” year and spent 10% of it every year, I’d still have turned $1000 into $18,882?

I’m not, No. Maths is.

I’m going shopping. Woohoo.

That’s completely up to you. We all set our own time preference.

If you decide that you’d like to release some of that hard-earned HODL value, go for it. You might just find, you never run out of money!

Why not get some Satsback at the same time.

Or maybe you should just Buy more Bitcoin!