Sure you can!

I first wrote this article in 2023, updated it in 2024 and here we are again, 16 years after the genesis block to do it all again.

Let me make one thing clear from the outset. I’m not saying you SHOULD spend your Bitcoin, I’m just saying you CAN.

But in true bitcoiner fashion…don’t trust, verify. So let’s run the numbers.

Let’s go back in time

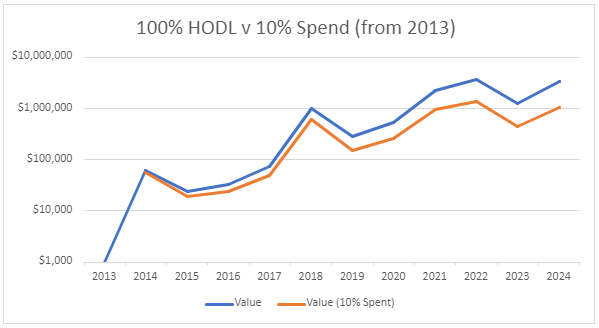

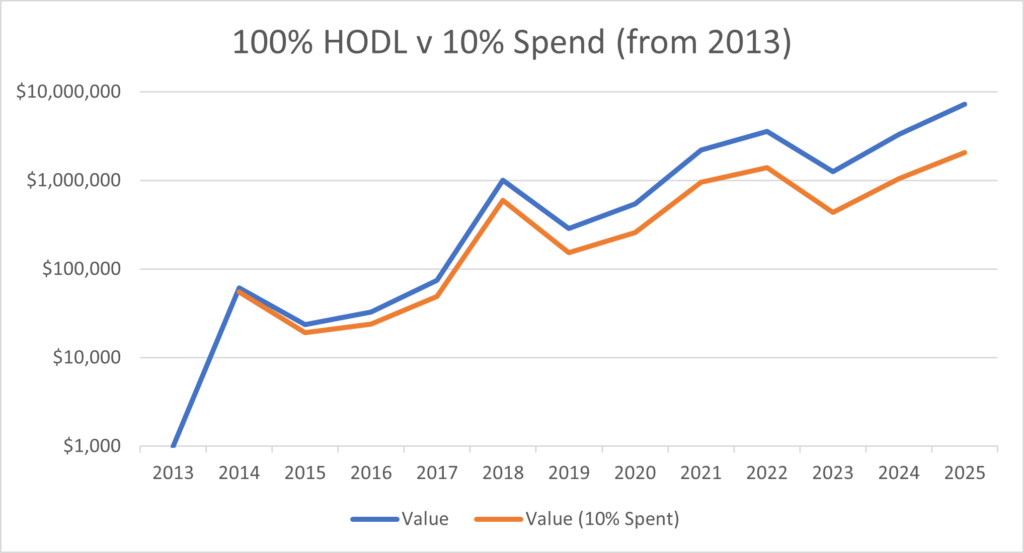

It’s the 1st of January 2013. You have no idea just how successful Bitcoin is going to be, but it’s a New Year and a new you. You decide to take a punt (and it was a punt back then) and allocate $1000 to Bitcoin (all data in USD).

At that time, 1 Bitcoin would have cost you $13.30 (yeah, it hurts me too) and you’d have just bought 75.19 BTC. Little did you know of the hero you were about to become!

The HODLER

The true heroes are not the buyers, they are the hodlers. Those with the courage to hodl their Bitcoin – securely – through all the volatility, mainstream media disinformation, family ridicule and shitcoin distractions. It sounds easy. It isn’t.

But you were that hero, and you made it to today, 3rd of January 2025. 1 Bitcoin is now worth $96,900.65 and your 75.19 a cool $7,285,763. Your (ex) colleagues call you lucky, and your degenerate gambling cousin is still waiting for his shitcoin to “moon”. Trust me bro’

But what if you’d spent 10% every year?

If you’d spent 10% every year, by 3rd January 2025 your 75.19 would now be “just” 21.24 BTC, but your $1000 now be worth $2,057,715!

That’s right, your wealth would be x2057 times greater even though you’d spent 10% every year. Cool, right?

Am I just cherry picking the data?

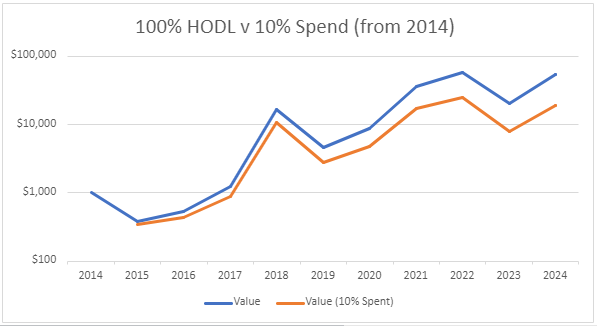

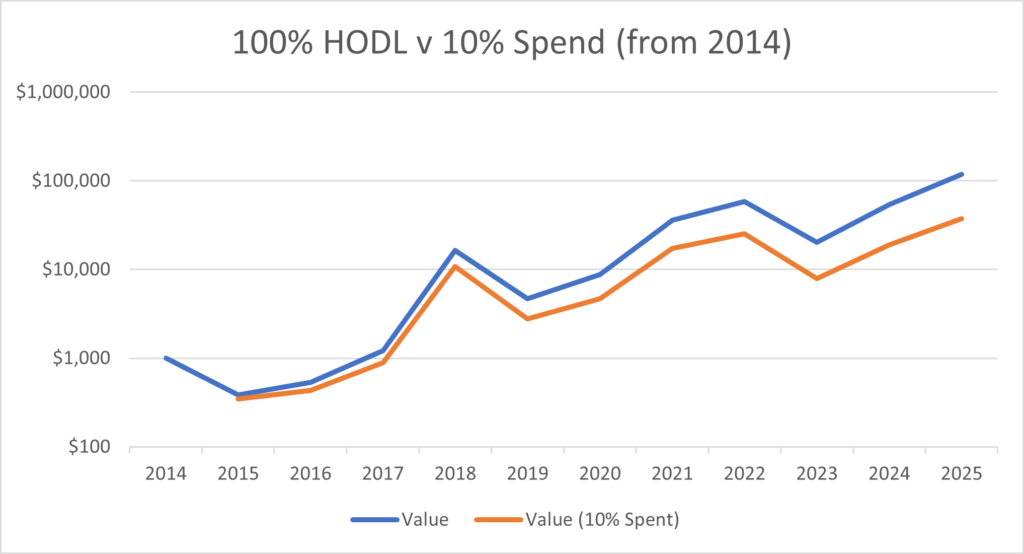

Yes! Why did I start this little experiment in January 2013? Well, that’s because it was a great point to buy Bitcoin, and it’d make me look clever. So let’s pick a “bad” point to start buying Bitcoin…January 2014. Why? Because for the next 2 years, the price of Bitcoin went down.

Imagine that you hadn’t listened to your smart friend Andreas and bought in 2013, but left it until 2014 and then got the FOMO. Well, that same $1000 now only bought you 1.23 Bitoin. What an idiot…or are you?

Back in the Time Machine

That 1.23 BTC is now worth $118,765. Not quite the 7285-bagger (or even the 2057-bagger), but x118 is still better than holding the Dollar, the Pound or the Euro.

But this must be the point where my argument falls apart, right? What if you bought at a “bad” time AND spent 10% every year?

Fear not, your 1.23 Bitcoin is now “only” 0.38 Bitcoin, but it’s worth $37,270!

Hang on, hang on…

…you’re telling me, that even if I bought Bitcoin at a “bad” time AND spent 10% every year, I’d still have multiplied my wealth by x37?

I’m not, no. Maths is.

The Decision is Yours

It’s not for me to tell you that you must save or should spend your Bitcoin. That’s fiat behaviour, and you’re a bitcoiner. I wouldn’t dare.

You can HODL forever or you can take a little off the top to make your life better.

I’ll just make 2 suggestions.

- However much you HODL, do it securely. You MUST take it off the exchange and into your own possession. If you’d like to find out how we can help you do that at The Bitcoin Adviser, book in for a free consult.

- If you decide to spend a little, I highly recommend both Fold and The Bitcoin Company to get some satsback when you do.

Conclusion

And that, fellow hodler, is how you live for free forever!

Happy New Year,

“Hats”